Are you an NHS staff member or retiree with questions about your pension? This comprehensive guide will explain the NHS Pension Scheme with a quick calculator to help you find answers.

We’ll cover how the NHS pension scheme works, how much you contribute and can expect in retirement, recent changes in 2025, and common FAQs like opting out, early retirement, and death benefits.

NHS Pension Contributions Calculator

Opt-Out Calculator

Early Retirement Calculator

You can also check your junior doctor salary after tax and monthly starting pay when considering NHS pension contributions.

This guide applies to the entire UK (England, Wales, Scotland, and Northern Ireland), with all regional NHS schemes following similar principles. Let’s dive in!

If you are wondering exactly how much your NHS pension could be worth, including lump sum options and early retirement adjustments, the easiest way to check is by using an NHS pension calculator. We’ve created a free NHS pension calculator tool on ScrubTales to help you work out what your pension could look like after 20, 25, or 30 years of service.

Whether you want to estimate your NHS pension lump sum or calculate your pension at 55 or 60 years old, our calculator gives a quick overview. It factors in contribution tier adjustments, annual pension increases, and the McCloud remedy updates.

You simply enter your average pensionable salary, years of service, and retirement age to see an estimate of your annual NHS pension amount and any tax-free lump sum.

Many people ask, how much is my NHS pension worth? Or how much NHS pension will I get after 20 years of service? These are exactly the kind of questions our calculator helps answer. It can also show what happens if you retire early and want to work out your NHS pension reduction at 55 compared to waiting until state pension age.

What Is the NHS Pension Scheme and How Does It Work?

The NHS Pension Scheme is a benefit provided to NHS employees that pays you an income for life when you retire.

For doctors applying to UK hospitals, our NHS clinical attachment cover letter template can help with early career steps.

In simple terms, it’s a defined benefit pension – not a personal pot of money you invest yourself, but a promise of a future pension based on your salary and years of service. Below we have the NHS pension explained in more detail:

- Three Scheme Sections: There are 1995, 2008, and 2015 NHS pension scheme sections. All new NHS employees now join the 2015 Scheme.

- The 2015 NHS Pension Scheme is the current scheme (a career average pension scheme), while the 1995 and 2008 sections (both final salary schemes) are closed to new entrants.

- If you built up benefits in the older schemes, you keep those, but any service from April 2022 onward builds under the 2015 scheme rules.

- Career Average vs Final Salary: The 2015 scheme works on a career average basis – each year you earn a pension amount equal to a fraction of that year’s pensionable earnings.

- By contrast, the 1995/2008 schemes were final salary – your pension was a fraction of your final (or best) salary times years of service.

- This means if you only ever pay into the 2015 scheme, your pension is based on your average earnings over your career (adjusted for inflation each year), whereas long-time staff with older schemes have part of their pension based on their ending salary.

- Accrual Rate: In the 2015 scheme, you build pension at 1/54th of your pensionable pay each year. That means each year you add roughly 1.85% of that year’s earnings to your eventual pension.

- These yearly amounts are revalued (inflation-adjusted) every year (with an added boost in the 2015 scheme – currently earnings are revalued by CPI inflation + 1.5% while you’re an active member).

- Over decades, these additions grow with inflation so your pension keeps its value.

- NHS Pension Age: The normal pension age (the age you can take your NHS pension without reduction) depends on the scheme:

- For the 2015 scheme, it’s linked to your State Pension age (currently 66-68 depending on your birth year). It will rise if the State Pension age rises.

- In the 2008 section, the normal pension age is 65.

- In the 1995 section, it’s 60 for most members (55 for a minority with “special class” status such as some nurses).

- Payments in Retirement: When you retire and claim your NHS pension, you will receive monthly pension payments for life. If you were in the 1995 section, you automatically get a tax-free lump sum (usually 3 times your annual pension) in addition to your monthly pension.

- In the 2008 and 2015 schemes, there is no automatic lump sum, but you have the option to take a tax-free lump sum by giving up (commuting) part of your pension if you wish (within HMRC limits).

- We’ll discuss lump sum tax questions later, but generally up to 25% of the total value can be taken tax-free.

- Who Runs the Scheme: The NHS pension isn’t invested in the stock market under your control – it’s backed by the government. NHS Business Services Authority administers the scheme in England and Wales, the Scottish Public Pensions Agency (SPPA) does in Scotland, and HSC Pensions in Northern Ireland.

- Despite separate administration, the benefits and contribution structure are very similar across the UK. If you work in the NHS anywhere in the UK, you’re automatically enrolled into the relevant NHS Pension Scheme.

In short, how does the NHS pension work? You and your employer contribute money while you’re working (more on contributions below).

In return, the scheme promises you a secure income in retirement, calculated from your earnings and service. It’s often considered a “gold-plated” pension because the benefits are generous and backed by the government, giving peace of mind for your future.

NHS Pension Contributions – What Are They and How Much Are They?

Let’s talk about NHS pension contributions – the amounts paid in to fund your future pension. As an NHS employee, a portion of your salary is deducted each month as your NHS pension contribution.

Your employer (the NHS trust or organization you work for) also pays a substantial contribution on your behalf. Here we explain what these contributions are and how much they cost:

What Are NHS Pension Contributions?

NHS pension contributions are the payments you and the NHS make into the pension scheme while you are working. Every month, a percentage of your pensionable salary is taken from your pay and put into the scheme.

The contributions are tiered – meaning the percentage you pay depends on how much you earn. Higher earners pay a higher percentage of their pay, and lower earners pay a lower percentage.

Preparing for interviews? Our complete NHS interview questions guide with templates is a helpful resource alongside pension planning.

These contributions go towards the overall NHS Pension Scheme fund (actually, it’s largely financed on a pay-as-you-go basis by the government), which in turn pays out pensions to retirees.

Key points about contributions:

- Auto-enrolment: When you start NHS employment, you are automatically enrolled and contributions begin from your first paycheck (unless you opt out). This ensures most people are saving for retirement by default.

- Tax relief: Your contributions are taken from your gross pay (before tax), so you get income tax relief automatically. For example, if you’re in the 20% tax bracket, a £100 pension contribution only £80 impacts your take-home pay (because £20 would have gone to tax if not contributed).

- National Insurance: Being in the NHS scheme can also reduce National Insurance contributions slightly, since the scheme was contracted-out of the additional State Pension (prior to 2016). This is a complex area, but just note that being a member had some NI advantages historically.

- NHS employer contribution: In addition to what you pay, the NHS (your employer) contributes a lot more – this is effectively a major part of your total reward package. We’ll cover employer contributions specifically below.

In summary, contributions are what fund your future benefits. What are the NHS pension contributions used for?

They are used to pay current pensions and secure your own pension promise (with government backing if costs exceed contributions). Now, let’s look at how much these contributions are in 2025.

How Much Are NHS Pension Contributions? (Contribution Rates)

The amount you pay is determined by your pensionable earnings. The NHS Pension Scheme has a tiered contribution rate system which is reviewed periodically.

As of 2025, the contribution tiers have been updated (with effect from 1 April 2025). Below is a table of the NHS pension contribution rates for employees in England and Wales (the rates in Scotland and Northern Ireland are very similar, with only minor differences in salary bands):

| Annual Pensionable Pay (full-time equivalent) | Employee Contribution Rate (2025/26) |

|---|---|

| Up to £13,259 | 5.2% of pay |

| £13,260 to £27,797 | 6.5% of pay |

| £27,798 to £33,868 | 8.3% of pay |

| £33,869 to £50,845 | 9.8% of pay |

| £50,846 to £65,190 | 10.7% of pay |

| £65,191 and above | 12.5% of pay |

Contribution rates are based on your actual annual pensionable pay (not whole-time equivalent). If you work part-time, your tier is determined by what you actually earn, not the full-time salary for your role.

For example, if you earn £20,000 a year (whether full-time or part-time hours), you fall in the 6.5% tier. These rates are correct for the 2025/26 financial year across the UK. (Scotland’s bands may vary by a few pounds in thresholds but the percentages are the same).

Note: These rates were changed in recent years to make contributions fairer:

- Before 2022, there were more tiers and part-time staff were assessed on their full-time equivalent salary (which often put part-timers in higher tiers unfairly). Now it’s based on actual pay, which is more equitable.

- The tiers have been consolidated so there are six tiers now, and lower earners saw slight increases in their percentage, while higher earners saw reductions, aiming for a more balanced structure.

- Each April, the salary thresholds are uplifted in line with inflation (so that if everyone’s pay goes up by e.g. 5%, people don’t all jump into higher contribution bands just due to inflation). In April 2025 there was an adjustment of the bands (they rose by about 1.7% in line with inflation, and further adjusted for the NHS pay award – see the “recent changes” section below).

Example: If you earn £30,000 a year, you pay 9.8% of that in pension contributions (£2,940 per year, which is £245 per month). If you earn £15,000, you pay 6.5% (£975/year, about £81 per month). These are your contributions – but remember, your take-home cost is less after tax relief.

NHS Employer Pension Contributions – Does the NHS “Match” My Contributions?

Many people ask, “Does the NHS match pension contributions?” The NHS scheme doesn’t match like a typical private employer might (for instance, some employers might match 5% if you put 5%).

If you’re looking for new roles, see our best 5 places to look for NHS jobs article.

Instead, the NHS as an employer contributes a standard hefty percentage for every member. Currently, NHS employer pension contributions in England and Wales are around 20.6% of your salary, and this increased to 23.7% from April 2024.

In Scotland and Northern Ireland, employer contributions are slightly over 22%. This is far above a simple match – the NHS is effectively putting an extra ~20p+ for every £1 you earn into the scheme for your future pension.

To put it plainly: while you might pay, say, 9.8% of your salary, your employer is paying an additional ~20% of your salary toward your pension. So for that £30,000 earner example, while you contribute ~£2,940 a year, the NHS trust would contribute around £6,000 a year on your behalf.

These employer contributions are not taken from your pay – you never see them, but they are a major benefit of being in the scheme. NHS employer pension contributions make the scheme extremely valuable; few private pensions offer such a generous contribution from the employer.

So, the NHS doesn’t “match” pound-for-pound what you put in – they put in much more. This is one reason opting out of the NHS pension is usually a bad idea financially, because you’d lose that employer contribution.

Can I Increase My NHS Pension Contributions? (Additional Contributions)

You might be thinking about boosting your future pension – “How do I increase my NHS pension contributions?”

The contribution rates we discussed above are fixed for the standard scheme benefits, and you cannot simply elect to pay more into the main scheme to get a bigger pension unless you take up specific options.

Balancing pension decisions with exam prep? Check out my post on how I passed MRCP Part 1 in two months while working full‑time for practical time management tips.

However, the NHS Pension Scheme offers several ways to increase your pension or add to it, if you want to contribute more money. Here are the main options:

- Additional Pension Purchase: You can buy additional pension from the scheme. This is basically an option to pay extra (either as a one-off lump sum or through additional monthly contributions) to get a defined extra amount of annual pension added to your benefits.

- For example, you could purchase an additional £1,000 per year pension payable at retirement. The cost for this depends on your age and other factors. This option increases your guaranteed pension (and will increase with inflation like the rest of your pension).

- Early Retirement Reduction Buy-Out (ERRBO): Specific to the 2015 scheme, ERRBO is a feature where you can pay extra contributions to lower your pension age (up to 3 years earlier than normal) without the early retirement reduction.

- For example, if your normal pension age is 67, you could pay extra so that you can retire at 65 or 64 with no reduction to your pension for early payment. This effectively costs extra while you’re working but gives you the flexibility to take full pension a bit earlier than normal.

- Additional Voluntary Contributions (AVCs): These are separate investment pots you can pay into alongside your NHS pension. The NHS scheme has arrangements with providers (like Prudential, Standard Life, etc.) for Money Purchase AVCs.

- If you choose, you can contribute extra money to an AVC, which is essentially like a personal retirement savings account. At retirement, you can use the AVC pot to get an extra lump sum or buy an annuity, etc.

- AVCs are defined contribution investments – not part of the main defined benefit scheme, but a way to save more with tax relief.

- Stakeholder or Personal Pensions: You can also contribute to a personal pension or stakeholder pension separately from the NHS scheme if you want to save more.

- This would be completely independent of the NHS pension, but is another avenue to increase your overall retirement savings.

- Half Cost Added Years (historical): In the old schemes (1995/2008), there used to be contracts to buy added years of service. Those are no longer available to new takers after those schemes closed, but if you had one in progress it might continue.

- This allowed members to pay extra to get additional years counted in final salary calculations. (Mentioned for completeness, though not applicable to new 2015 scheme joiners.)

In summary, if you’re wondering how to increase NHS pension contributions or benefits, the main way in the 2015 scheme is to either buy Additional Pension or ERRBO through the scheme, or save separately via an AVC or other pension.

You can’t just tell payroll to deduct an extra, say, 5% and have it automatically boost your NHS pension – you have to go through one of these specific arrangements.

If you’re interested in these, you should contact NHS Pensions or check the member hub for Increasing your pension for details and application forms.

Tip: Increasing your pension is entirely optional. Many members find the standard scheme already sufficient. But if you started your NHS career later or want to retire earlier with a bigger income, these options can help bridge the gap.

How Much Pension Will I Get? (Estimating Your NHS Pension)

A big question for any pension is, “What will I actually receive when I retire?” The NHS pension can be complex to calculate, so it’s best to get an official estimate for your own case.

However, we can discuss general ideas and examples to give you a sense. People often frame it as: “How much NHS pension will I get after 10 years? 20 years? 25 years? 30 years?” Let’s break this down.

First, remember the factors that determine your pension:

- Your earnings (higher salary = larger pension).

- Your years of service (more years = larger pension).

- Which scheme you’re in (2015 is career average; 1995/2008 were final salary with different accrual rates).

- Inflation adjustments over time (the career average portions get uprated each year).

Make sure you’re covered with the best medical indemnity insurance options for UK NHS doctors, which is essential alongside pension and benefits.

Pension Build-Up Examples for Different Service Lengths

To give a rough idea, let’s assume you are in the 2015 career average scheme for your entire NHS career. We’ll also assume your salary is roughly stable in real terms (adjusted for inflation) for simplicity. Here’s a simple projection:

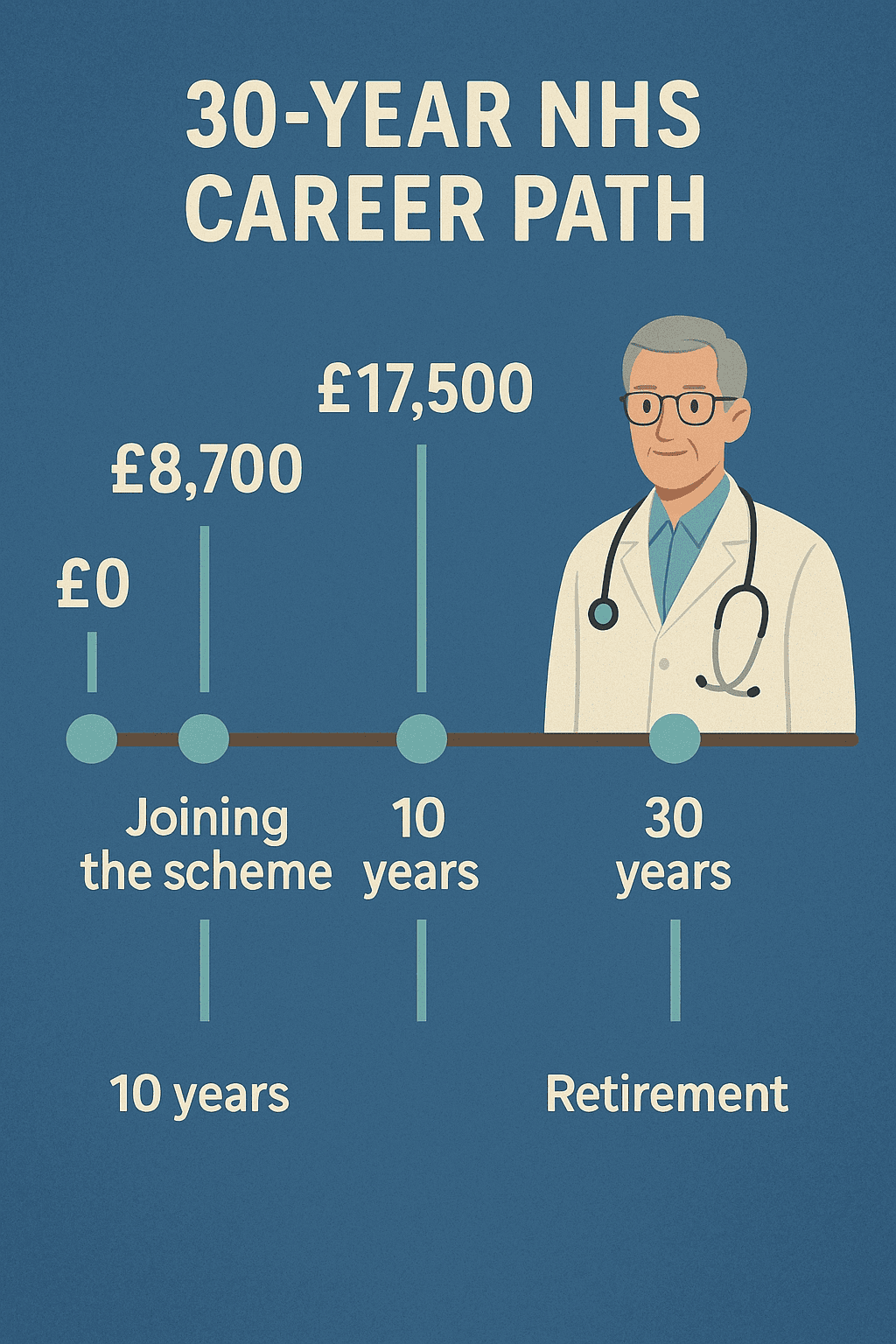

- After 10 years of NHS service: You will have accrued roughly 10/54 of your average pensionable salary as annual pension. That is about 18.5% of your salary. For example, if your salary averaged around £30,000 in those years, you might get on the order of £5,500 per year as pension (around £460 per month) at retirement from those 10 years of work.

- After 20 years: You’d have roughly 20/54, which is 37% of your salary. If your average salary was £30,000, that could be about £11,000 per year (around £917 per month). So if someone asks “How much NHS pension will I get after 20 years?” – very approximately, maybe around one-third of your ending salary per year as pension.

- After 25 years: 25/54 is about 46% of your salary. If average salary was £35,000 by the end (assuming some promotions/increases), the pension might be around £16,000 per year (≈ £1,333 per month).

- After 30 years: 30/54 is 55.5% of your salary. If your later-career salary is, say, £40,000, your pension might be on the order of £22,000 per year (about £1,833 per month).

These are very rough estimates just to illustrate. In reality, your pension from the 2015 scheme is calculated each year and revalued, so if your pay rises over time your later years add more pension than your earlier years.

The above scenarios assume some average salaries for simplicity. If you have older 1995/2008 service, the calculation is different (final salary fraction).

For instance, “How much NHS pension will I get after 30 years” in the 1995 section might be roughly 30/80 (since that scheme gave 1/80 of final salary per year) = 37.5% of final salary as pension, plus an automatic lump sum of 3 years’ worth of pension.

Average NHS Pension per Month (What Do Pensioners Typically Get?)

People are curious about the average NHS pension per month. It’s tricky to give a single figure because it varies widely:

- Many NHS staff work part-time or don’t spend an entire career in the NHS, so their pensions can be relatively modest.

- On the other hand, doctors or senior staff who have high salaries and long service can have quite large pensions.

One way to look at it: The median NHS pension (the middle value) is often cited around £4,000–£7,000 per year (roughly £300–£600 per month).

That low figure is skewed by many who left early or worked part-time. A full-time nurse or allied health professional with a long career might retire on, say, £10k–£20k per year pension (£800–£1,600 per month).

Doctors and consultants who worked 30+ years might see pensions in the £30k–£50k/year range (several thousand per month).

In other words, there is no one “average” that tells you what you will get. Your annual benefit statement (issued each year, usually accessible online) is the best way to see what you’ve accrued so far.

You can also request a formal pension estimate as you get closer to retirement. The scheme also provides NHS pension calculators online to model scenarios.

NHS Pension Examples

Let’s consider a couple of NHS pension examples to illustrate:

- Example 1: “Alice” – 20 years service. Alice has worked as an NHS nurse for 20 years. Her salary over her career averaged £28,000 (in today’s terms).

- After 20 years in the 2015 scheme, she might have accrued roughly £10,000 per year pension. If she continued to 30 years, and her salary later averaged £35,000, she might end up with around £18,000 per year pension.

- That would be her pension for life, indexed to inflation each year.

- Example 2: “Dr. Brown” – mix of 1995 and 2015 schemes. Dr. Brown worked 15 years in the NHS before 2015 in the old 1995 section, and 10 years after 2015 in the new scheme (25 years total).

- His final salary was £80,000. From the 1995 portion, roughly 15/80 of £80k = £15,000 annual pension, plus a lump sum of ~£45,000. From the 2015 portion, 10 years accrual maybe averaging £70k salary = ~£13,000 annual pension.

- In total, his pension might be around £28,000 per year (plus the lump sum) on retirement at age 60 (for the 1995 part; the 2015 part he can take at his state pension age, or slightly earlier with reduction).

- This example shows how someone with high earnings and long service can have a substantial pension.

These examples are over-simplified but give a flavor. The bottom line: the more years you work and the higher your pay, the more you will get, but even after 10 or 20 years you will have built a meaningful benefit.

Always check your own statements for accurate figures.

Opting Out of the NHS Pension Scheme

The NHS Pension Scheme is an excellent benefit for most people – but you might be considering whether to opt out of the NHS pension.

For financial planning, here are top 5 bank accounts for new NHS staff that work well with salary and pension contributions.

Common reasons some think about opting out include short-term financial pressure (to take home a bit more pay) or if they are nearing retirement and have specific plans.

Here we’ll explain how to opt out of the NHS pension, what it involves, and the consequences.

How to Opt Out of NHS Pension – Step by Step

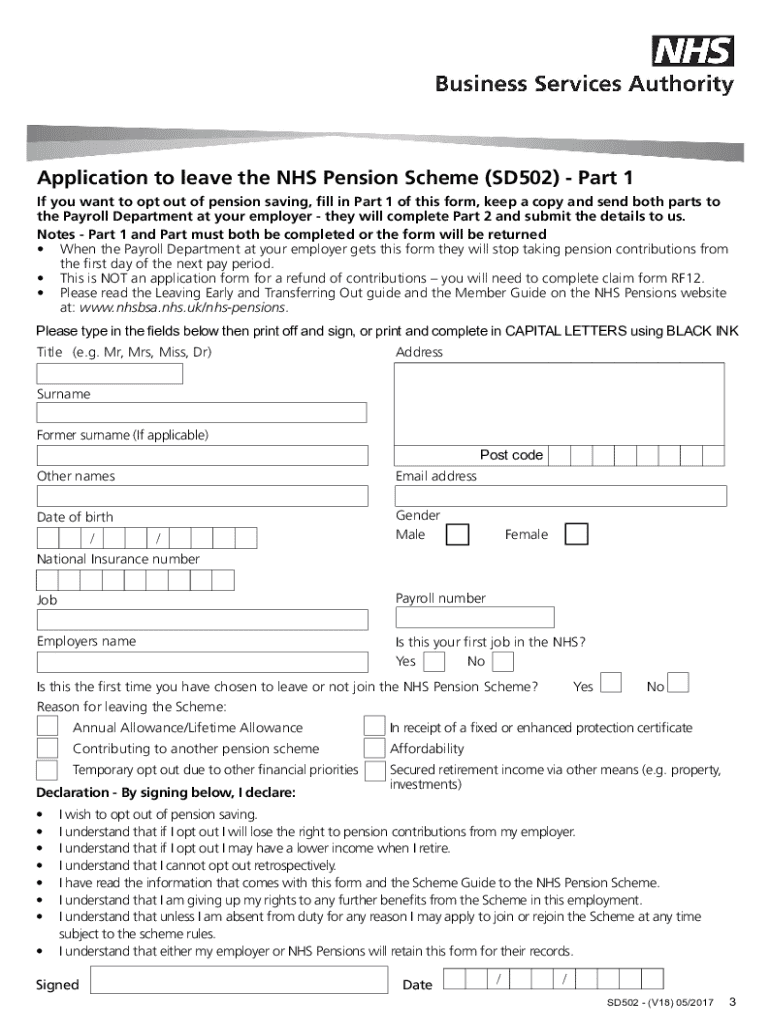

If you decide to opt out, the process is straightforward but requires an official form. To opt out of the NHS Pension Scheme, you must complete form SD502 (the NHS pension opt-out form).

Your employer can’t fill this for you (and due to auto-enrolment rules, they’re not even supposed to hand you the form proactively), so you need to obtain it yourself. Here are the steps:

How to Opt Out of NHS Pension

Download or request the opt-out form (SD502)

This form is usually available on the NHS Business Services Authority website or from your local HR/payroll. It’s often titled “Application to leave the NHS Pension Scheme (SD502)”. Make sure you get the official form.

Read the form and notes carefully

The form will explain the implications of opting out – such as losing death in service cover and employer contributions. It will list the benefits you will be giving up if you opt out. Ensure you understand this.

Fill out your details in Part 1

Provide your personal information, National Insurance number, employer details, etc., and sign the declaration that you wish to opt out. You will need to confirm you understand the consequences.

Submit the form to your employer

Give the completed form to your payroll or HR department (if you’re a GP or dentist, there are specific instructions like sending to PCSE in England). The employer (or NHS Pensions for certain staff groups) will complete Part 2 to process your opt-out.

Effective date

If you opt out within one month of starting your NHS job (or within one month of being auto-enrolled/re-enrolled), the opt-out can be backdated to your start date and any contributions already deducted may be refunded via payroll. If you opt out later, it will normally take effect from the next available pay period after the form is processed – any contributions paid up to that point stay in the scheme for you (unless eligible for a refund, discussed below).

Check your payslips

Once processed, your payslips will no longer show pension deductions and you’ll see an increase in take-home pay (since you stopped contributions). Confirm that the opt-out has been actioned.

Opting out means you stop building up NHS pension benefits going forward. Importantly, while you are opted out:

- You lose the employer’s contribution. That ~20% of salary the NHS was putting in on your behalf is gone for the period you’re out of the scheme.

- You also lose the death in service benefit (a lump sum and pension benefits for your family if you died while still employed). After opting out, if the worst happened, there wouldn’t be the same payout as if you were a member.

- You will still keep any pension you have already earned from previous service – it will be preserved (deferred) until retirement. Opting out doesn’t forfeit what you’ve accrued; it just stops future accrual.

Auto-enrolment note: Even if you opt out, by law your employer must re-enroll you periodically (typically every 3 years on a re-enrolment date) if you’re still eligible.

You can choose to opt out again at that time if you still want to, but it’s meant to nudge people to reconsider.

Before opting out, it’s often advised to seek financial advice or at least calculate the value of what you’re giving up. In almost all cases, staying in the NHS pension is very beneficial long-term, even if the take-home pay reduction pinches now.

Remember, opting out of NHS pension means losing a secure indexed pension for life – something that’s hard to replicate with private savings unless you’re investing a lot.

If you’re filling out HR forms, our guide to completing the CREST form for MSRA may be useful.

NHS Pension Refund of Contributions (Leaving the Scheme Early)

If you opt out or leave the NHS entirely, you might wonder what happens to the contributions you’ve already made. Can you get a refund of your NHS pension contributions?

The answer depends on how long you’ve been in the scheme:

- Less than 2 years of NHS pension membership: If your total scheme membership is under two years (and you haven’t transferred in a pension from elsewhere), you may be eligible for a refund of your contributions. This means you can get back the money you paid in (minus tax and minus the cost of reinstating you into the State Second Pension for pre-2016 membership). To do this, you need to fill out a pension refund form (called form RF12). You would send this to NHS Pensions (often via your employer if you are still employed or directly if you’ve left). After processing, they’ll pay you your contributions back (with deductions for income tax and National Insurance adjustments). Note: you only get your own contributions refunded – not the employer’s part.

- 2 or more years of membership: If you have two or more years in the scheme, you cannot get a refund of contributions. Instead, whatever pension you have accrued is preserved. You will have a deferred pension payable at retirement age. Even if you leave the NHS now, that deferred pension will sit and grow with inflation and be there for you later. The only way to access it earlier might be to transfer it out to another pension scheme (and even then, you generally can’t cash it out under age 55). So once past 2 years, you’re essentially a vested member with a pension coming in the future – no cash refunds.

- If you rejoin later: If you have a deferred pension and then return to NHS work, you can usually link the service back up (depending on the break length) or just start a new pot. It’s common for people to leave and later rejoin the NHS – their earlier benefits remain intact and they start accruing again when they come back.

So, if you opted out with very short service and want your money back, the NHS pension refund form (RF12) is your route. Keep in mind, taking a refund cancels your membership for that period – you won’t have any pension rights for that time.

Many people who leave after, say, 18 months of service take the refund because the pension would be tiny and far in the future. But if you’re close to 2 years, sometimes staying to vest can be worthwhile.

Should You Opt Out?

This is a personal decision, but generally the NHS pension is considered extremely valuable. When you opt out, you’re giving up not just your own contribution (which you could use elsewhere) but also a significant employer contribution and a guaranteed benefit.

It may make sense in a few scenarios (for example, some higher earners concerned with annual allowance/tax issues, or someone who is terminally ill, or those in serious short-term financial hardship), but for the vast majority, staying in is the best long-term choice.

If your reason is “I can’t afford the contributions,” consider that contributions are tiered (lower if you earn less) and come with tax relief. The actual hit to take-home pay might be smaller than you think.

And if you truly can’t afford it now, remember you will be auto-enrolled again in a few years, so you have chances to reconsider.

Lastly, note that opting out is not irreversible – you can opt back in. If you change your mind, you can rejoin the scheme by asking your employer to enroll you (usually from the next pay period).

So if you have opted out and later realize you want the security of the NHS pension, you’re allowed to rejoin.

Retirement Options and FAQs for NHS Pensions

Now let’s cover some common questions about retiring with an NHS pension – including early retirement, taking your 1995 section pension, tax on your lump sum, and what happens if you die in retirement.

Housing costs matter when planning retirement savings. See house rent in the UK for NHS staff for a breakdown.

NHS Pension Early Retirement – Can I Retire Early?

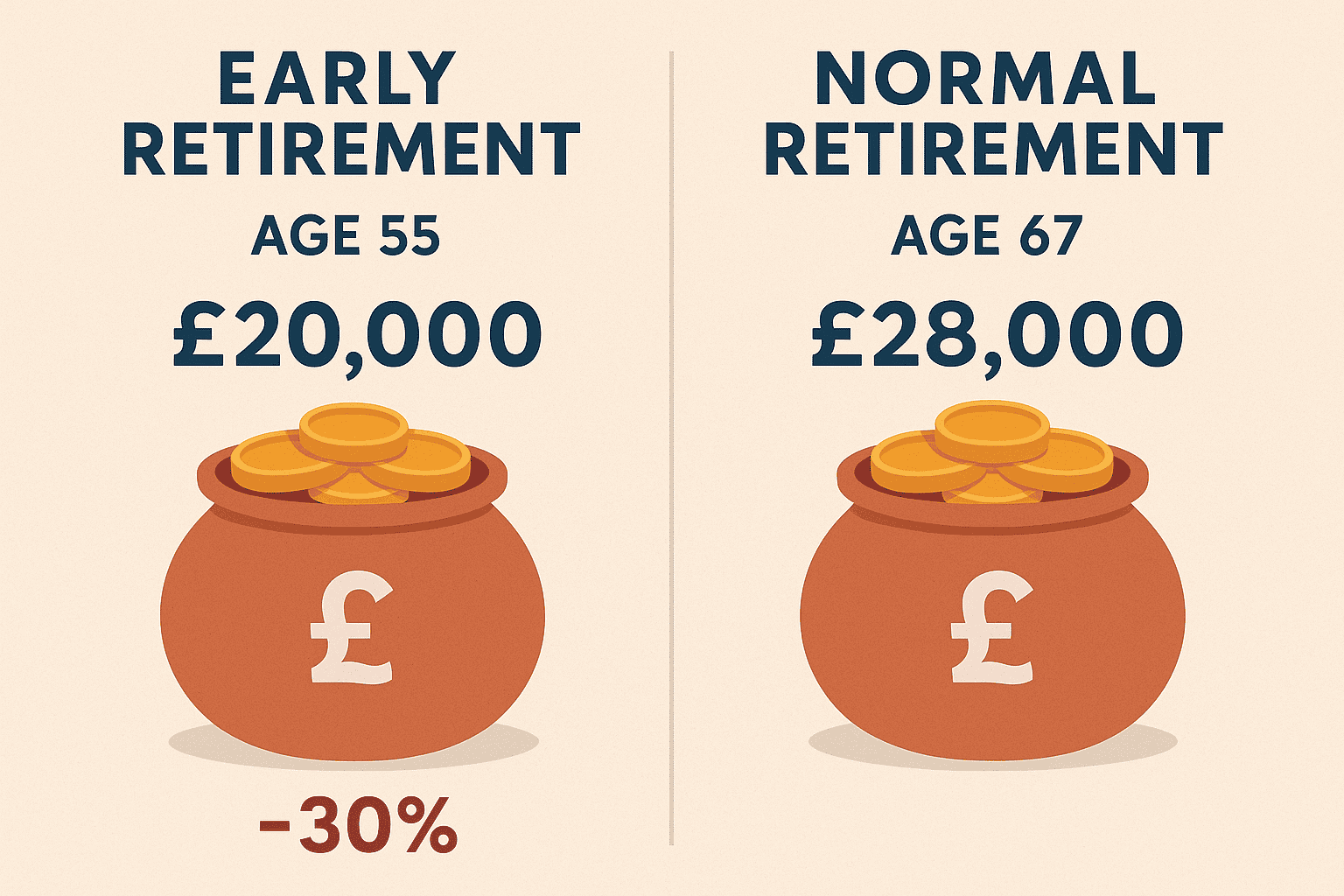

Yes, the NHS Pension Scheme does allow early retirement, but with reductions. “Early retirement” usually means taking your pension before your normal pension age for that scheme.

- Minimum Retirement Age: For most people now, the minimum age you can start drawing your NHS pension (unless on ill health grounds) is 55. (It was 50 for some older members who joined before 2006, but those cases are fewer now. From 2028, the minimum will rise to 57 for all schemes due to a law change, but as of 2025 it’s 55.)

- Actuarial Reduction: If you choose to take benefits early, your pension is actuarially reduced – essentially a permanent reduction to account for the fact that you’ll be receiving it for more years. The earlier you retire, the larger the reduction. For example, in the 2015 scheme if your normal pension age is 67 and you retire at 60, your pension might be reduced by roughly 30% (just an illustrative figure) because you took it 7 years early. Each scheme has specific reduction factors.

- Voluntary Early Retirement: Taking benefits from, say, the 1995 section at 55 (instead of 60) or from the 2008 section at 60 (instead of 65) is possible with reductions. The 2015 scheme similarly allows taking it from 55 onwards (instead of, say, 67). You have to leave NHS employment or take flexible retirement to do this.

- Early Retirement Reduction Buy-Out (ERRBO): As mentioned earlier, the 2015 scheme lets you pay extra to retire up to 3 years early without reduction. If you did an ERRBO, you could, for instance, take your pension at 64 instead of 67 with no reduction, because you prepaid for those years.

- Ill Health Retirement: Separate from voluntary early retirement, if you develop a serious health condition that forces you to stop working, you might be able to get your pension early on ill health grounds.

- In ill health retirement, there is no reduction for early payment; in fact, you may even get an enhancement (extra years credited) if you are permanently unable to work.

- Ill health retirement has strict medical criteria and two tiers of benefits depending on severity. This is something to explore with NHS Pensions and your employer if unfortunately needed.

So, NHS pension early retirement is definitely possible. Many NHS staff choose to retire a few years early, accepting a smaller pension in exchange for more years of leisure.

Be sure to request an estimate of the reduced pension before making the decision, so you know what income to expect.

Do I Have to Take My 1995 NHS Pension at 60?

If you’re a member of the old 1995 Section, you might have heard that 60 is the normal pension age. A common question is: “Do I have to take my 1995 NHS pension at 60, or can I work longer?” This can be a bit confusing:

- In the 1995 Section, age 60 is indeed the normal retirement age (for most members). Technically, you are supposed to cease pensionable employment by that age.

- In fact, under the old rules, if you continued working in the NHS beyond 60, you stopped building up any more pension in the 1995 section (you couldn’t earn more years beyond 60).

- Prior to recent changes, you also couldn’t remain in that section beyond 60, and there were no actuarial increases for late retirement – the scheme was designed assuming you’d take it at 60.

- So, you don’t have to take it at 60, but it’s usually advantageous to do so. If you keep working for the NHS after 60 (and many do), you have a few choices:

- Retire and rejoin: One common approach is to officially retire at 60 (trigger your 1995 pension and take the lump sum), and then return to NHS work, in which case you’d be enrolled into the 2015 scheme for any further work.

- There used to be a restriction (the “16-hour rule” where you couldn’t work more than 16 hours per week in the first month after retirement) – but that rule has been removed. Now you can retire, take your pension, and return to work after a short break (usually a minimum 24-hour break in service is required) without that 16-hour limitation.

- As of late 2023, the rules even allow 1995 Section members to retire and then rejoin the 2015 scheme if they return, which is a new flexibility.

- Continue working and defer claiming: Alternatively, you could just continue working past 60 and not claim your 1995 pension yet. However, importantly, the 1995 Section does not reward you for late retirement with extra increases.

- Your pension (and lump sum) essentially remain as they would have been at 60 (just uprated for inflation). You also are not contributing anymore because you can’t accrue beyond 60 in that scheme.

- So you gain nothing by leaving it unclaimed while working – in fact, you’re missing out on pension payments you could have taken. That’s why most people in the 1995 section do take it at 60.

- Retire and rejoin: One common approach is to officially retire at 60 (trigger your 1995 pension and take the lump sum), and then return to NHS work, in which case you’d be enrolled into the 2015 scheme for any further work.

- If you do defer taking it and keep working, when you eventually claim it (say at 62 or 65), you’ll get the same pension (inflation-adjusted) you were entitled to at 60.

- There is no penalty for late claiming, but no bonus either. Essentially, you gave up some years of receiving it.

Bottom line: You’re not legally forced to take your pension at 60, but from a financial perspective, there’s little reason not to if you’re in the 1995 section.

Many will choose to “retire” at 60 (at least for a day or two) to claim their pension and then continue working in some capacity, since otherwise you leave money on the table.

If you’re in the 2008 section, normal age is 65; you can work longer and that scheme does have late retirement factors (it will increase if you delay after 65, up to 75).

The 2015 scheme also has late retirement factors – if you delay taking it past your state pension age, your pension will increase by a certain percentage for each year delayed (since you’re shortening the payout period).

But 1995 was an exception with no late retirement uplift.

Is the 1995 NHS Pension Lump Sum Taxable?

One great feature of the NHS pension (and most UK pensions) is the tax-free lump sum. The question often arises: “Is the 1995 NHS pension lump sum taxable?”

The answer is no, it’s not taxable. In the 1995 section, when you retire, you automatically get a lump sum that is 3 times your annual pension. This lump sum is paid out of the scheme and is completely tax-free under current HMRC rules. It does not count as taxable income.

For example, if your annual pension is £10,000, your 1995 section lump sum would be around £30,000, tax free. You’ll get that immediately on retirement, and then the £10,000/year pension is paid (the pension income is taxable as income in the year you receive it, like any pension or salary would be).

In the 2008 and 2015 schemes, since there’s no automatic lump sum, you have the option to exchange part of your pension for a lump sum.

Any lump sum you take (up to the allowed limit, usually 25% of the total value) is also tax-free. This is just the standard pension rule in the UK – usually up to 25% of your pension pot’s value can be taken as a tax-free lump sum.

So whether it’s the automatic lump from 1995 or an elected lump sum from 2015/2008, that cash is not taxed. The only caveat: extremely large pensions can be subject to lifetime allowance rules.

However, as of 2023, the government has effectively removed the Lifetime Allowance charge (and it’s expected to be abolished entirely in legislation).

That means even big pensions no longer face extra tax at retirement beyond normal income tax on the pension payments. But even under the old lifetime allowance, the lump sum portion up to a certain limit was protected tax-free.

In summary, the 1995 NHS pension lump sum is tax-free. Enjoy it! Just remember your ongoing pension is taxed as income (so plan for that in retirement, e.g., via PAYE on your pension payroll).

Lastly, don’t forget to explore the full NHS discounts and offers list to make the most of your NHS benefits package.

What Happens to My NHS Pension If I Die After Retirement?

Thinking about what happens to your pension if you pass away is important, especially for making sure your family is provided for. The NHS Pension Scheme provides death benefits both if you die in service (while still working) and if you die in retirement (after you’ve started drawing your pension).

Here we’ll focus on after retirement, since the question often is phrased as: “What happens to my NHS pension if I die after retirement?”

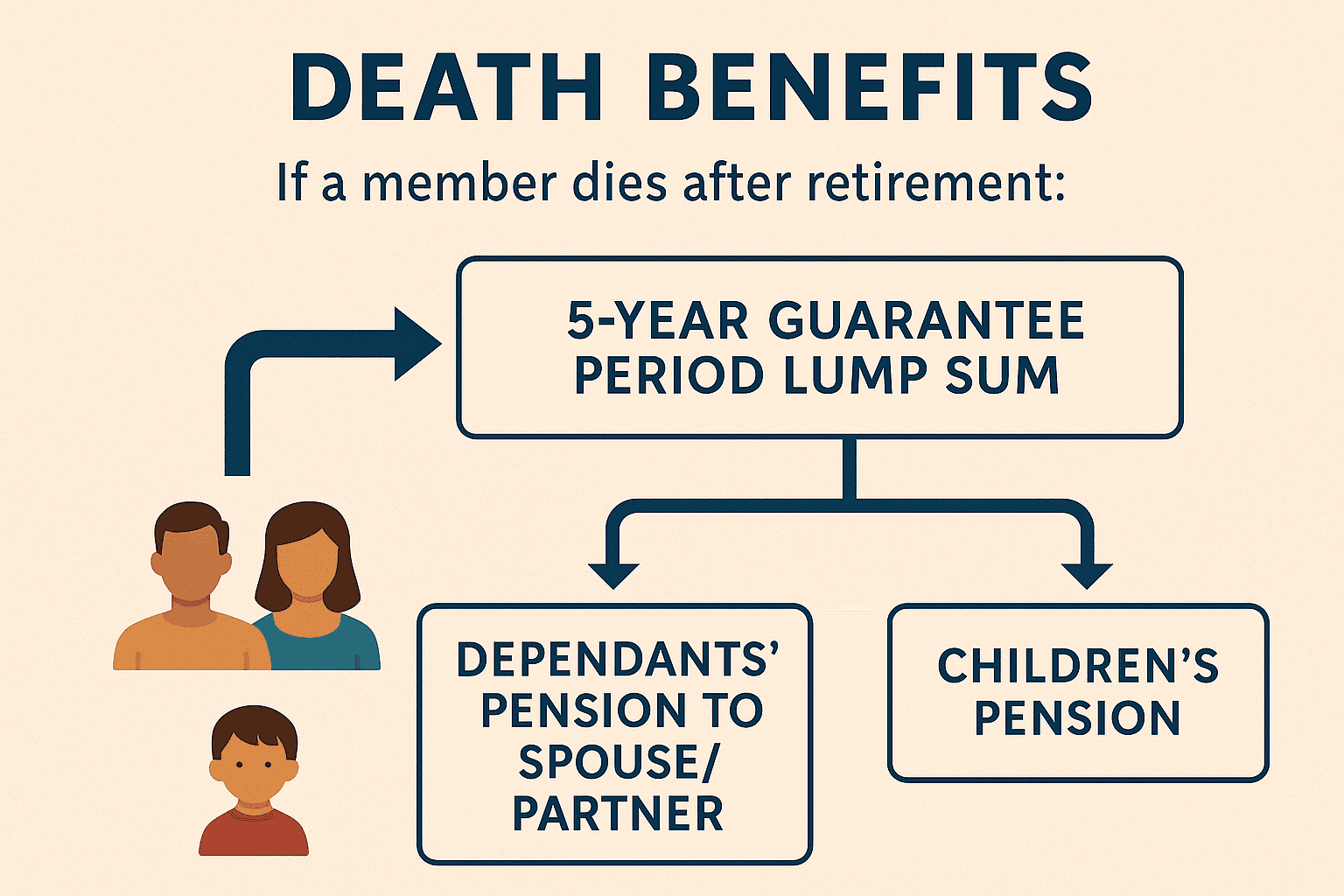

If you die after you have retired and are receiving your NHS pension:

- Lump Sum on Death (Guarantee period): There is a guaranteed pension period of 5 years from retirement in the NHS scheme. If you die before you’ve received 5 years’ worth of pension payments, the scheme will pay out a lump sum covering the balance of the 5-year amount.

- For example, if you retired exactly 2 years ago, and your annual pension is £10,000, you have received £20,000 so far. Five years of payments would be £50,000, so the remaining guarantee would be £30,000. That £30,000 would be paid as a lump sum death benefit, usually to your nominated beneficiary or estate.

- If you die after the 5-year period has passed, no lump sum is payable (because the scheme has paid at least five years of pension to you already).

- Dependants’ Pensions: The NHS pension provides ongoing pensions to your eligible dependants after you die. This typically includes:

- Spouse or Civil Partner Pension: Your surviving spouse or registered civil partner will receive a pension for life. This is usually a fraction of your pension. In the 2015 scheme, it’s generally 1/2 of your pension (50%). In 1995/2008, it’s around 1/2 as well (with some differences if marriage happened after retirement, etc.).

- If you weren’t married but have an eligible partner, the 2008 and 2015 schemes allow a nominated cohabiting partner to get a pension, provided certain conditions are met (like you were living together, financially interdependent, etc.).

- The 1995 section does not pay a pension to unmarried partners – only legal spouses (or certain exceptions for survivors of same-sex couples who couldn’t marry historically).

- Children’s Pension: If you have dependent children (usually under age 23, or any age if they are disabled and dependent), they will receive a pension as well.

- Typically each child might get about 25% of your pension (the exact fraction depends on number of children and whether there’s a spouse also receiving a pension). These payments continue until the child reaches adulthood (or 23 if still in full-time education) or for life if the child is permanently disabled and dependent.

- Spouse or Civil Partner Pension: Your surviving spouse or registered civil partner will receive a pension for life. This is usually a fraction of your pension. In the 2015 scheme, it’s generally 1/2 of your pension (50%). In 1995/2008, it’s around 1/2 as well (with some differences if marriage happened after retirement, etc.).

- No Dependants? If you have no spouse/partner or dependent children, then there wouldn’t be ongoing pensions to pay out after your death. In that case, the only death benefit would be any lump sum remaining within the 5-year guarantee window.

- If you die after 5 years and have no dependants, effectively the payments stop and there’s no further payout (which is how a pension scheme works – it’s to provide income for your life; it’s not like a savings account with a balance to inherit, aside from the structures above).

- Nomination: It’s crucial that you nominate who you want any death lump sum to go to. You should fill out a nomination form with NHS Pensions (and update it if circumstances change).

- This will ensure any lump sum (e.g., the remainder of 5-year guarantee, or if you die in service, the death-in-service lump sum which is usually 2x salary) goes to the person you intend, without delays from estate processing.

In summary, if you die after retirement, your NHS pension doesn’t just vanish. For a period it’s protecting you (the 5-year guarantee) and it provides for your loved ones via dependant pensions.

For example, a surviving spouse will generally get half of your pension for the rest of their life, which can be a significant financial security. So your pension is not only for you – it has features that continue to care for your family after you’re gone.

It’s one of the generous aspects of defined benefit schemes like the NHS’s.

(If the question was about dying before retirement: briefly, if you die as an active member, a lump sum of 2x your annual pay is paid out, and your spouse/partner/children get similar pensions as described. And if you die with a deferred pension, a lump sum of 5x deferred pension is paid plus dependants’ pensions. So there are provisions at all stages.)

Recent Changes to the NHS Pension Scheme (2025 Updates and News)

The NHS Pension Scheme has undergone some updates recently. Here we will highlight changes or updates to the NHS pension scheme that are relevant in 2024–2025, since many employees and retirees are curious about what’s new.

In particular, there was talk about NHS pension scheme April 2025 changes and questions about pension increases in 2025.

Contribution Tier Changes in April 2025

One of the key April 2025 changes relates to contribution tier thresholds:

- As we saw in the contributions section, the salary bands for the contribution rates were uplifted on 1 April 2025. This means the cut-off points for each percentage tier went up slightly (by approximately 1.7% initially, in line with inflation).

- This was done to ensure that the Agenda for Change pay rise in 2025 wouldn’t inadvertently push lots of staff into higher contribution rates.

- In fact, the pay award for 2025/26 (in England) ended up being higher than 1.7% (it was around 3.5-4% in that year), so the Department of Health adjusted the bands further to accommodate that. The table we provided for 2025/26 is the result after those adjustments.

- In practice, this means many members will stay in the same contribution tier even after their pay increase, or some might even drop a tier if their pay didn’t rise as much as inflation. The goal was to keep contributions fair and not take away most of the pay award.

Additionally, a regulatory change was made effective April 2025 clarifying that overtime for part-time staff up to full-time hours is pensionable. Most employers already treated additional hours for part-timers as pensionable pay, but there was some ambiguity in the 2015 scheme wording.

The rules now clearly state if a part-time employee works extra shifts up to the equivalent of full-time hours, those earnings count toward their pension (and contributions are deducted accordingly). Only hours beyond full-time (if someone somehow works over 37.5 hours consistently) would be non-pensionable.

Employers were instructed to inform any affected staff and allow them to pay arrears if needed to pensionize past overtime. This change just ensures part-time staff don’t miss out on building pension from extra shifts.

NHS Pension Increase 2025 – Cost of Living Rise for Pensions

Each April, pensions in payment (and deferred pensions) are increased by the Treasury, following inflation. This is called the Pensions Increase (PI).

For April 2025, the inflation measure (CPI from September 2024) was relatively low compared to recent years. The NHS pension increase in 2025 was 1.7%.

Common questions:

- “NHS pension rise 2025 – when will it be paid?” – The annual increase takes effect from the first Monday after 5 April. In 2025, that date was 7 April 2025. So pensioners saw their pension payments go up by 1.7% from that point. If you’re a pensioner, the payment in April (or May, depending on pay cycle) included the uplift from 7 April onward. This is automatic – you don’t need to do anything.

- The 1.7% may sound small because inflation was higher in previous years. Indeed, in April 2024 the increase was over 10% (reflecting the high inflation of 2023). By 2025, inflation had dropped, hence the smaller rise. If your pension began only recently (for example in late 2024 or early 2025), you don’t get the full 1.7% – it’s prorated if you’ve been retired for less than a year. Anyone who retired after late March 2025 wouldn’t get that April’s increase at all (since their pension wasn’t in payment when the increase applied).

- This increase applies UK-wide, as it’s set by Treasury Orders each year (Scotland, etc., all follow the same percentage PI for public service pensions).

So in summary, NHS pensioners got a 1.7% uplift in April 2025. This might be referred to on official sites (gov.uk) as the “NHS pension increase 2025/26” being 1.7%.

It’s worth noting this is separate from any State Pension increase, which is handled differently (but in 2025 the State Pension was likely increased by the triple lock, possibly a different figure).

Other Notable Updates

- Removal of the 16-hour rule & Retire and Return: In 2022-2023, some temporary relaxations (due to COVID workforce needs) were made permanent. The old rule requiring a maximum of 16 hours work in the first month after taking pension was scrapped. And from late 2023, those who took 1995 section benefits can actually rejoin the pension scheme (2015 section) if they return to work, as long as they’re under 75. This is a big change enabling experienced staff to come back to work without losing out on pension accrual for the new period.

- McCloud Remedy (Public Service Pension Remedy): You may have heard about pension scheme age discrimination court cases (McCloud) affecting the NHS scheme. In short, these were changes to undo the transitional arrangements from 2015 that were deemed discriminatory. The remedy is in progress: all active members were moved to the 2015 Scheme from April 2022, and those who had been moved in 2015 but were originally in 1995/2008 get a choice at retirement which scheme benefits they want for 2015-2022 period. This is an ongoing administrative process (the McCloud remedy), but as a member you don’t usually have to do anything yet except be aware you’ll have a choice later if affected. This is mentioned because it’s a significant scheme update, though it mostly concerns the back-end correction of benefits for those who were mid-career around 2012.

- 2025 Scheme Regulations Tweaks: The government did a consultation and made some minor amendments effective April 2025 (besides contributions). For example, incorporating provisions for new kinds of leave (e.g., neonatal leave counting as pensionable), and clarifying how contributions are calculated during periods of reduced pay (ensuring that if your pay drops, your contribution tier is based on actual pay, which it has been since 2022, and making sure anyone overpaying gets a refund). These changes are mostly technical and to ensure fairness and consistency.

In essence, the NHS Pension Scheme April 2025 changes you should know about are:

- Slightly adjusted contribution bands (so you might see a small change in your contribution if you got a pay rise).

- Continuous improvement in how part-time extra hours are handled (good news: more pensionable overtime for part-timers).

- A 1.7% increase for pensions in payment from April 2025 (pension rise).

- Ongoing efforts to implement the McCloud remedy (if you’re affected, you’ll be communicated to by NHS Pensions with options).

- For most members, these changes don’t require action – they’re happening in the background or automatically.

Always keep an eye on communications from NHS Pensions or your employer’s pension updates for any changes. The scheme evolves over time, but changes are communicated via official channels and often covered in NHS news.

Conclusion

The NHS Pension Scheme is a complex but incredibly valuable part of your employment benefits. We’ve covered how it works, from contributions (what you pay in and what the NHS pays in for you) to benefits (how much pension you might get after 20 or 30 years, etc.), as well as key options like opting out or increasing your pension, and important FAQs about retirement age, lump sums, and family benefits after death.

We also looked at the latest 2025 updates, which fine-tuned some rules but kept the scheme’s core benefits strong.

For NHS employees, understanding your pension helps you appreciate the long-term value it brings. For NHS retirees, knowing the rules ensures you’re getting what you’re entitled to and that your loved ones are protected.

The target audience for this information – whether you’re early career, mid-career, or retired – can hopefully find answers to common questions here in a friendly, digestible way.

In a nutshell, the NHS Pension Scheme remains one of the best pension arrangements in the UK, providing a guaranteed, inflation-proof income in retirement.

It’s like a reward for your years of service caring for others: in return, the scheme takes care of you in your golden years. Make sure to stay informed, check your annual statements, and plan your retirement with confidence.

And if you’re ever unsure, reach out to your pension administrator or resources – they can provide personalised details for your situation.

NHS Pension Contributions FAQs

How much are NHS pension contributions in 2025?

NHS pension contribution rates in 2025 range from 5.2% to 12.5% depending on your pensionable pay. Employer contributions are around 23.7% in England and Wales.

How much NHS pension will I get after 20 years?

After 20 years of service in the 2015 NHS Pension Scheme, many members can expect a pension worth around 35–40% of their average salary. Exact amounts vary by pay and service history.

Does the NHS match pension contributions?

The NHS doesn’t match contributions in the usual sense. Instead, your employer pays a fixed contribution rate—currently much higher than employee rates—at around 23–24% of your salary.

How do I opt out of NHS pension contributions?

You can opt out by completing form SD502 and submitting it to your employer’s payroll or HR department. Opting out stops your contributions and employer contributions but preserves pension rights already earned.

What is the NHS pension lump sum?

In the 1995 Section, there’s an automatic tax-free lump sum. In the 2008 and 2015 schemes, you can choose to take a lump sum by giving up part of your pension, up to HMRC limits.

How does the McCloud remedy affect NHS pensions?

The McCloud remedy allows affected NHS staff to choose between old and new pension scheme benefits for the period between 2015 and 2022. This ensures fair treatment for members across all age groups.