You have settled down a bit, but you need a bank account for your salary? Everyone waits for the pay day, and this should be the top priority in the task which requries sorting asap.

As an NHS healthcare professional, one of the first things you’ll need to do when settling into your new life is open a bank account. This guide will walk you through everything you need to know to ensure the process is as smooth as possible.

Why You Need To Open Bank Account?

You are definitely not going to save a lot of money (shattered dreams!) as the cruelty hits later on, but you can indeed use some NHS discounts to ease your heart.

Opening a UK bank account is essential for your daily life here. It will allow you to:

- Receive your salary from the NHS

- Pay bills and rent easily

- Access essential services like healthcare and transportation

- Use contactless payments for everyday purchases, including groceries and transport

- Set up savings accounts and manage your finances

- Build up credit score for future requisites

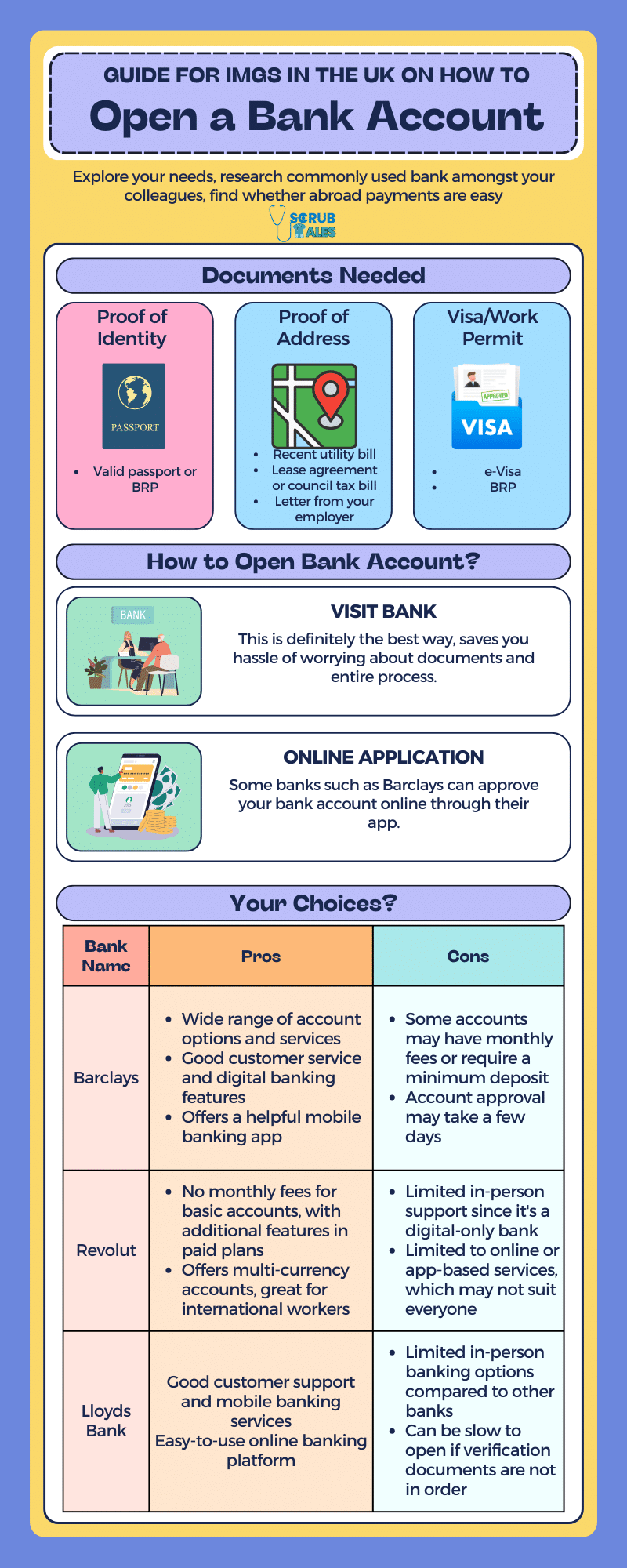

What You’ll Need to Open an Account

Each bank may have slightly different requirements, but generally, you will need to provide the following documents:

- Proof of Identity

- Valid passport or BRP

- European or UK driving license (if applicable)

- National ID card (for EU nationals)

- Proof of Address– You can get the following even if you are renting a house:

- Recent utility bill (gas, water, or electricity)

- Bank statement (if you’re already a customer with another bank)

- Lease agreement or council tax bill

- Letter from your employer (the NHS in this case), confirming your employment and UK address

- Visa or Work Permit

- If you’re a non-UK resident, you may need to provide a visa or work permit that confirms your eligibility to work in the UK.

Choosing the Right Bank

There are many banks to choose from in the UK, but some may be more suitable for your needs as an NHS worker, particularly if you’re new to the country.

Some banks offer specific packages for international professionals, with support in different languages and simplified processes for newcomers. Here are a few popular banks:

- Barclays: Barclays offers accounts for international workers and provides an easy online process for setting up your account.

- HSBC: HSBC has a great service for newcomers to the UK and offers an “International Account” with features that can be useful for international professionals.

- Lloyds Bank: Lloyds provides specialized accounts for international students and healthcare professionals with a good online banking experience.

- NatWest: Known for good customer service, NatWest is another popular choice for new arrivals, with a user-friendly banking app and good support for international workers.

- Revolut: Revolut is an excellent option for those who prefer digital banking. It offers a fully mobile-based account with features like multi-currency accounts, low-cost international transfers, and a user-friendly app. Revolut is particularly popular among international workers due to its simplicity and ease of use. You can open an account entirely online, and it’s a great choice if you’re comfortable with managing finances via an app.

Personally, I went for Barclays as I was thinking long term with forethought of house and car, the essentials of life. On the other hand, my wife went for Revolut as this bank account is fairly easy to use when transferring money abroad.

Pros and Cons of UK Bank Accounts

| Bank | Pros | Cons |

|---|---|---|

| Barclays |

|

|

| HSBC |

|

|

| Lloyds Bank |

|

|

| NatWest |

|

|

| Revolut |

|

|

The Process of Opening an Account

Opening a bank account in the UK can be done in person at a branch, online, or sometimes via post. Here’s the typical process:

- Visit the Bank’s Website or Branch: You can either start the process online or visit a branch in person. Many banks will allow you to start your application online and finish the process in a branch if needed.

- Submit Your Documents: During the application process, you’ll need to upload or provide your documents (proof of identity, address, visa/work permit, etc.).

- Wait for Confirmation: The bank will review your application and, once approved, will send your bank card and account details to your address.

- Activate Your Account: Once you receive your card, you can activate your account by following the instructions provided by your bank (usually through an online banking app or over the phone).

Let’s dive into processes for opening bank account in each one of the mentioned in the list:

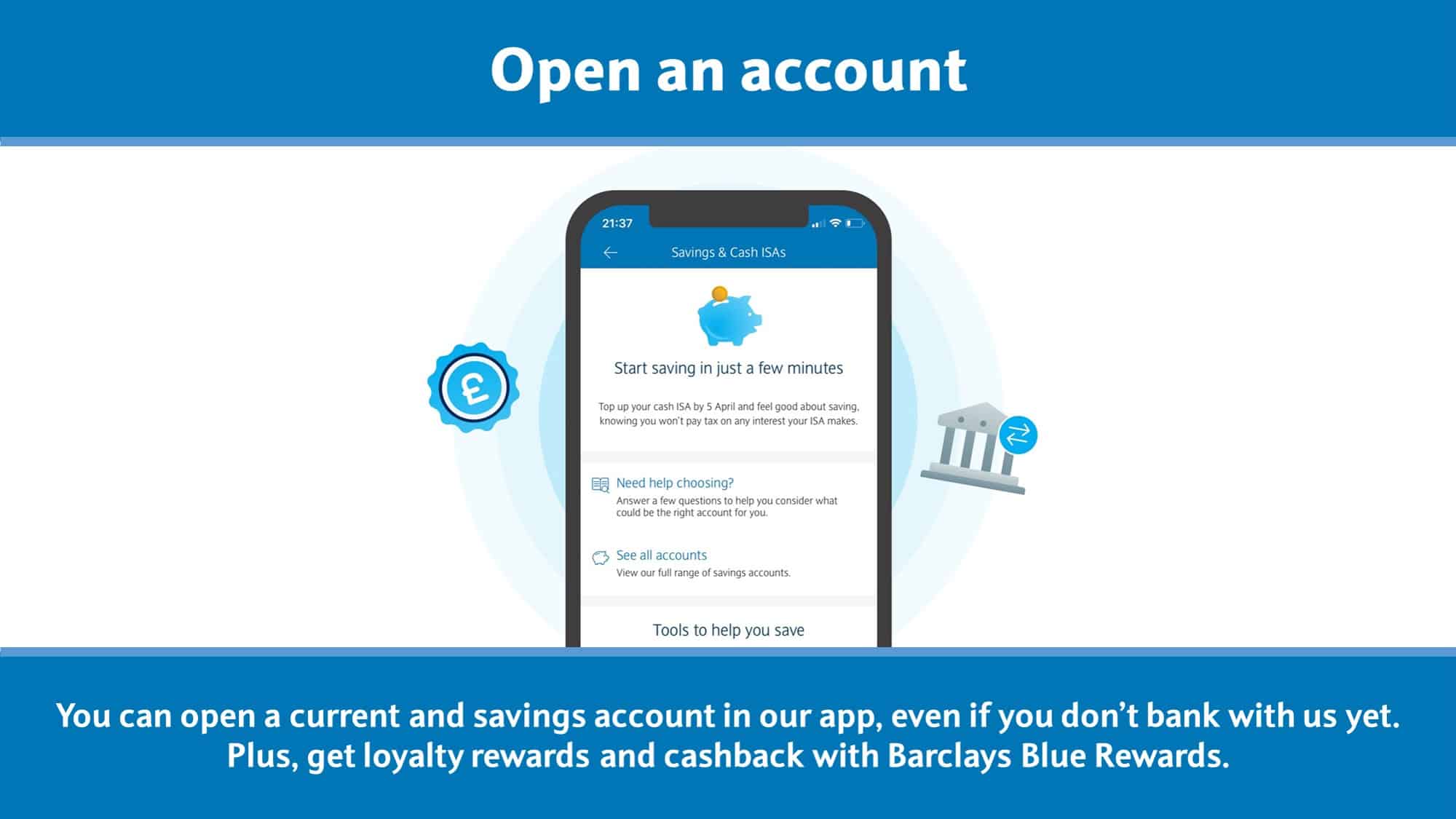

1. Barclays

Process:

- Online: Start the application online via the Barclays website or app. You’ll need to upload proof of identity (passport, driving license) and proof of address (utility bill, council tax, etc.).

- Branch: If you prefer, visit a Barclays branch to open your account in person. Bring your documents and meet with an advisor.

- Documents Required: Proof of identity, proof of address, and employment details (optional, but helpful for some account types).

Time to Open: A few days to a week, depending on the method chosen.

2. HSBC

Process:

- Online: You can start the process online by visiting HSBC’s website and selecting an account type. You will need to provide your identification documents and proof of address.

- Branch: If you prefer, you can visit an HSBC branch and open an account with the help of a bank advisor.

- Documents Required: Passport, national ID (if applicable), proof of address (utility bill, bank statement), and work visa (for non-UK residents).

Time to Open: Usually 5–10 business days.

3. Lloyds Bank

Process:

- Online: Start your application on the Lloyds Bank website. Upload your proof of identity and address. They may ask for additional information depending on the account type.

- Branch: Alternatively, you can go into a branch to open the account in person. Bring your documents and meet with an advisor to complete the process.

- Documents Required: Proof of identity, proof of address, and employment confirmation (helpful but not always necessary).

Time to Open: Typically 5-7 business days for online applications.

4. NatWest

Process:

- Online: You can open an account by visiting NatWest’s website and following the instructions. Upload your required documents (ID and address proof).

- Branch: Visit a NatWest branch to open your account in person if you prefer. Staff will help guide you through the process.

- Documents Required: Passport or ID, proof of address (utility bills, rental agreement), and visa/work permit (for non-UK residents).

Time to Open: Accounts are typically activated within 7 business days after submitting your application.

5. Revolut (Digital-Only)

Process:

- Online: Revolut is an entirely digital bank. Download the Revolut app, sign up, and provide the necessary documents by uploading them directly through the app. You can verify your identity using a selfie and your ID.

- Documents Required: Valid passport, national ID, proof of address (can be uploaded via the app), and a selfie for identity verification.

Time to Open: Usually within 1–2 business days if all documents are in order.

Here is a short useful video on opening revolut bank account:

Top Tips for a Smooth Process

- Check for Special Accounts for International Workers: Some banks have packages tailored for healthcare professionals or international workers. These accounts may come with perks like fee-free international transfers or easy access to emergency funds.

- Start the Process Early: Opening a UK bank account can take a few days to a few weeks, so don’t wait until you need it urgently. Plan ahead to ensure you’re all set when you arrive.

- Use Online and Mobile Banking: UK banks offer robust online banking and mobile apps. Download your bank’s app to easily manage your finances on the go.

- Understand Bank Charges: Be aware of any fees associated with your account, such as ATM withdrawal fees, overdraft charges, or monthly account maintenance fees.

What to Do if You Have Trouble

If you face challenges opening an account, don’t be afraid to ask for help. The bank staff are used to working with international workers and should be able to guide you through the process. You can also seek help from fellow NHS workers who have already navigated the process.

Do I need to open a UK bank account as an NHS healthcare professional?

Yes, opening a UK bank account is essential for receiving your salary, paying bills, managing your finances, and accessing various services like transportation and healthcare.

Can I open a UK bank account before arriving in the UK?

It’s generally not possible to fully open a UK bank account before arriving, especially if you don’t have a UK address. However, some digital banks, like Revolut, allow you to start the sign-up process online while still abroad.

What documents do I need to open a bank account in the UK?

Typically, you’ll need:

1. Proof of identity (e.g., passport, national ID, or driving license)

2. Proof of address (e.g., utility bills, council tax bill, rental agreement)

3. Work visa or permit (for non-UK residents)

Can I open a bank account with a temporary address?

Yes, many banks allow you to use a temporary address (such as a hotel or NHS accommodation) as proof of address. If you have trouble, a letter from your NHS employer can also serve as proof of your UK address.

How long does it take to open a UK bank account?

It can take anywhere from a few days to a week for most traditional bank accounts. Digital banks like Revolut may allow you to set up an account much faster (within 1-2 days).

Are there any fees for having a UK bank account?

Some UK banks charge monthly maintenance fees, especially for premium or packaged accounts. However, many basic bank accounts (e.g., with Barclays, NatWest) are fee-free. It’s important to check for any fees or conditions attached to the account you choose.

Can I use an international bank account to receive my NHS salary?

While it’s possible, it’s much easier to have a UK bank account for receiving your salary. Most UK employers, including the NHS, prefer paying into UK-based accounts. Additionally, international transfers can incur extra fees.

Do I need a UK credit history to open an account?

No, most banks do not require a UK credit history to open a basic account. However, some banks may check your credit history if you’re applying for overdrafts or loans.

Is it safe to use online-only banks like Revolut?

Yes, Revolut and other online-only banks are regulated and offer strong security measures, including encryption and fraud detection systems. However, they are not typically covered by the UK’s Financial Services Compensation Scheme, so it’s important to be aware of the risks involved with digital-only banking.

Can I have multiple bank accounts in the UK?

Yes, you can open multiple bank accounts in the UK. Many people choose to have one account for their salary and another for personal savings or expenses.

What was your experience in opening bank account as a doctor?

We’re here to explore. Let’s talk.