Whether you are looking for the cheapest or the best indemnity insurance coverage providers, you surely have landed at the best place to compare them all.

While starting your career as a Doctor in the NHS, we often have to check the costs before picking one, and that my friend, is not an easy task.

Most of the newcomers to the NHS in the UK do not understand the concept of medical indemnity coverage for doctors. The common myth that NHS coverage is enough is fairly common within us.

How Much Did It Cost Me?

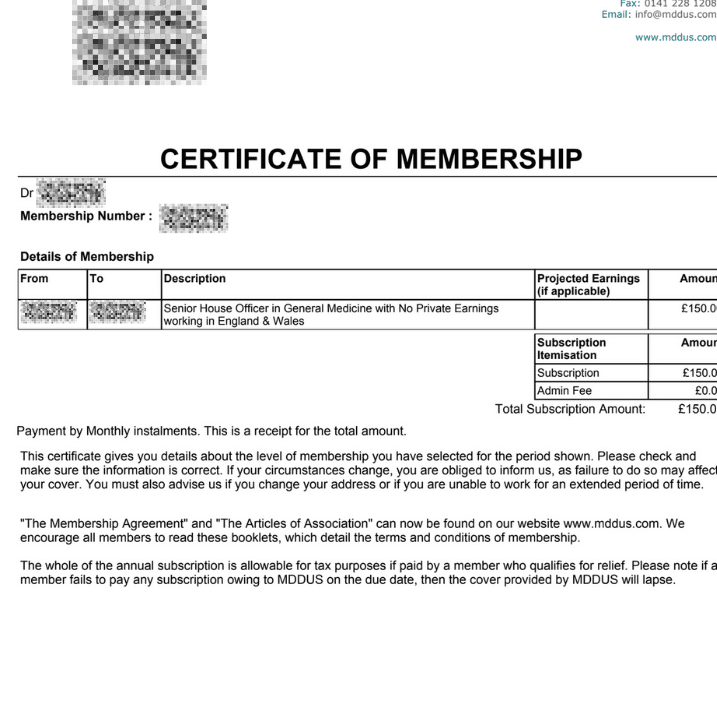

I am FY2 in Geriatrics. When I compared the quotes given by the companies I have mentioned below, I found MDDUS reasonable (I was merely looking at cost to be honest).

It cost me £150 in total for an year, and I pay £15 per month (still don’t know how but regardless, is cheap).

Here is my certificate:

With the NHS Staff Benefits that come along with the job, you also get to pay more sadly.

Let’s dive into the in-depth of the topic and explore what are our top possible options, starting from basics if you are new in the UK. We will compare the list with a table and provide a cost comparison at different grades as well.

What is Indemnity Coverage?

In simple terms, refers to insurance that protects doctors against legal liability, should a claim be made against them due to a medical error, negligence, or failure to perform their duties.

This coverage provides financial protection, covering the cost of legal defense, settlements, and compensation.

In the UK, it is a legal requirement for doctors. Without it, you cannot practice medicine or provide patient care.

The NHS, through the government and various medical defence organizations, offers various schemes to ensure that healthcare professionals are adequately protected.

Why Is Indemnity Insurance Important for NHS Doctors?

- Legal Protection: If a patient files a complaint or claims compensation for alleged medical errors, having one ensures that doctors are not financially liable for the full amount.

- Support in Case of Investigations: If you are investigated by a regulatory body like the General Medical Council (GMC), the coverage ensures you have access to legal support.

- Peace of Mind: Practicing medicine can be stressful, especially when you’re faced with difficult cases. Having medical cover provides peace of mind knowing you’re covered for unexpected legal or financial challenges.

- Appraisals: Very frequently, appraisee ask these questions- ‘Do you have indemnity insurance coverage?’. Hence, it becomes one of the key things to achieve.

Here is what GMC has to say on this topic in case you are looking for more information.

Types of Indemnity Insurance Coverage

- NHS Indemnity (State-backed Scheme)

For doctors working in the NHS, cover is typically provided through the state-backed NHS indemnity scheme. This provides comprehensive cover for the doctor when working in NHS settings, including during clinical practice, teaching, and research activities related to your NHS role. This is often sufficient for most NHS doctors, but there may be specific circumstances where additional cover is needed. - Medical Defence Organizations (MDOs)

Many doctors also choose to join a Medical Defence Organization (MDO). These organizations provide additional coverage for things like private practice, independent work outside the NHS, and legal representation.

Some popular MDOs include:- The Medical Protection Society (MPS)

- The Medical Defence Union (MDU)

- The Medical and Dental Defence Union of Scotland (MDDUS)

- Private Insurance

If you take on work outside of your NHS duties, such as private practice or consultancy, private insurance may be necessary. This coverage is vital if you’re working in areas that fall outside the scope of what NHS offers.

In other words, there are three types:

- Incident-based: Incidents that take place within the policy period are covered by occurrence-based coverage, regardless of when the claim is filed.

- Claims-made cover: Regardless of when the incident happened, claims filed during the policy period are covered by claims-made coverage.

- Run-off cover: Offers protection against claims submitted after you’ve retired or left the medical field.

These organizations often offer tailored packages for NHS doctors, including risk management advice, legal representation, and support in case of complaints or investigations.

Top Indemnity Insurance Comparison

There are certain factors which you must consider before picking the one best for you:

- Coverage limitations: Verify that the coverage limitations meet your demands.

- Premium Plans: Evaluate other providers’ price of premiums.

- Terms and Conditions: The policy’s terms and conditions should be carefully examined.

- Customer service and credibility: Dig into the customer assistance and reputation of the company.

Here’s a comparison of the best 5 companies that provide indemnity coverage for NHS doctors in the UK:

| Company | Coverage | Additional Benefits | Cost | Membership |

|---|---|---|---|---|

| MPS (Medical Protection Society) | Clinical negligence, regulatory investigations, complaints handling, private practice | Risk management, 24/7 legal support, educational resources | Based on experience and specialty | Trainees, Junior doctors, Consultants |

| MDU (Medical Defence Union) | Clinical negligence, regulatory issues, legal defense, private work | Risk management, member support | Flexible pricing system | Multiple membership levels |

| MDDUS (Medical and Dental Defence Union of Scotland) | Clinical negligence, GMC investigations, criminal defense, private work | Personalized service, legal advice | Based on specialty and experience | Tailored packages for medical professionals |

| NHS Indemnity (State-backed) | Clinical negligence for NHS work, legal defense | Backed by the government, no membership fee | Free for NHS staff | NHS-employed doctors only |

1. Medical Protection Society (MPS)

- Overview: MPS is one of the best and most well-established medical defence organizations in the UK. It provides comprehensive indemnity coverage for NHS doctors, including legal support, risk management advice, and assistance with complaints.

- Coverage: Includes clinical negligence claims, regulatory investigations, criminal investigations, and complaints handling. MPS also covers private practice and non-clinical work if applicable.

- Additional Benefits: Offers access to a wide range of educational resources and risk management support. It also provides 24/7 legal advice for members.

- Costs: The cost depends on factors like the type of work, experience level, and specialty. MPS offers a tiered pricing system based on these factors.

- Membership: Provides various membership levels, including options for trainees, junior doctors, and senior consultants.

2. Medical Defence Union (MDU)

- Overview: The MDU is another leading provider of indemnity coverage for NHS doctors. It has a long history and offers tailored policies, including those for private practice and non-clinical work.

- Coverage: Covers clinical negligence, regulatory issues, legal representation, and assistance with complaints. MDU also offers cover for private work, including consultancy, teaching, and surgery.

- Additional Benefits: Provides additional support for members, including a range of services designed to mitigate risk and improve clinical practice.

- Costs: The MDU has a flexible pricing model based on your specific needs. The cost depends on the doctor’s role (e.g., specialty or experience level).

- Membership: Offers multiple levels of membership, including comprehensive packages for consultants and GP members.

3. Medical and Dental Defence Union of Scotland (MDDUS)

- Overview: MDDUS is a UK-based medical defence organization providing indemnity coverage to NHS doctors in England, Scotland, and Wales. It offers a comprehensive service for NHS doctors, covering clinical negligence, regulatory investigations, and complaints.

- Coverage: MDDUS covers clinical negligence claims, GMC investigations, criminal defense, and complaints handling. It also offers additional cover for private practice.

- Additional Benefits: Known for offering personalized service and expert legal advice. MDDUS also has strong educational support services to help doctors minimize risk in practice.

- Costs: Membership costs vary depending on your specialty and experience, with special pricing for trainees, junior doctors, and consultants.

- Membership: MDDUS has a strong reputation for offering tailored packages and excellent customer service to both medical and dental professionals.

4. Indemnity from the NHS (State-backed Scheme)

- Overview: The NHS indemnity scheme is a state-backed scheme that covers NHS doctors who are employed in NHS settings. It offers comprehensive coverage for clinical practice within the NHS, including legal protection and risk management advice.

- Coverage: Includes cover for clinical negligence claims, legal defense, and regulatory investigations for work carried out in NHS roles. It also provides cover for certain non-clinical duties if required.

- Additional Benefits: It is backed by the government, meaning there’s no need for a separate membership fee. It also offers peace of mind that you’re fully covered for your NHS role.

- Costs: Typically free of charge for NHS employees, as the government provides coverage for NHS staff.

- Membership: Only available to doctors directly employed by the NHS. Trainees, GPs, and consultants working solely within NHS roles are covered under this scheme.

How Much Do The Best Medical Indemnity Insurance Cost?

The cost of best indemnity coverage varies depending on several factors such as the doctor’s grade, specialty, and whether they are working in NHS or private practice.

Below are some rough estimates for different grades of doctors, though actual rates may differ and it’s always best to get quotes directly from the providers.

1. Medical Protection Society (MPS)

- Foundation Year 1 (F1) and Foundation Year 2 (F2): £100 – £250 per year

- Specialty Trainee (ST) or Core Trainee (CT): £300 – £600 per year

- Consultants: £700 – £1,500 per year (can be higher for high-risk specialties)

- GPs: £300 – £1,200 per year (depending on private work)

2. Medical Defence Union (MDU)

- Foundation Year 1 (F1) and Foundation Year 2 (F2): £120 – £250 per year

- Specialty Trainee (ST) or Core Trainee (CT): £250 – £500 per year

- Consultants: £600 – £1,200 per year (higher for high-risk specialties)

- GPs: £400 – £1,500 per year (depending on private work)

3. Medical and Dental Defence Union of Scotland (MDDUS)

- Foundation Year 1 (F1) and Foundation Year 2 (F2): £120 – £250 per year

- Specialty Trainee (ST) or Core Trainee (CT): £300 – £600 per year

- Consultants: £700 – £1,500 per year (higher for high-risk specialties)

- GPs: £300 – £1,200 per year (depending on private practice)

4. NHS Indemnity (State-backed Scheme)

- Foundation Year 1 (F1) and Foundation Year 2 (F2): Free (covered by NHS scheme)

- Specialty Trainee (ST) or Core Trainee (CT): Free (covered by NHS scheme)

- Consultants: Free (covered by NHS scheme)

- GPs: Covered by NHS scheme if employed by NHS; private work may require additional coverage

Key Factors Influencing Cost

- Specialty: High-risk specialties like surgery, obstetrics, and cardiology tend to have higher premiums due to the increased likelihood of claims.

- Grade: Junior doctors (F1/F2) usually pay lower premiums compared to consultants due to their level of responsibility and experience.

- Private Practice: If a doctor engages in private work outside of their NHS role, they will typically need additional indemnity, which can increase the cost.

- Location and Role: If a doctor works in high-risk areas (e.g., emergency medicine or obstetrics) or locations with higher claims frequency, the cost may increase.

These are rough estimates, and actual premiums may vary. It’s always best to reach out to each provider for a precise quote based on your specific circumstances.

Do You Need Extra Coverage?

While the NHS scheme covers most aspects of clinical work within the NHS, there are situations where you may need to seek extra coverage:

- Private Work: If you undertake private consultations, surgery, or other activities outside your NHS contract, you may need to take out separate coverage.

- Non-Clinical Work: If your work involves teaching, management, or consultancy, you might need extra cover for the non-clinical aspects of your role.

- Volunteer Work or Work Abroad: If you’re involved in volunteer work or working overseas, check with your provider to ensure you’re covered in those circumstances.

Do I need indemnity coverage as an NHS doctor?

Yes, this is required for all doctors practicing in the UK, including those working in the NHS. It is a legal requirement to ensure you are protected from potential claims related to your clinical duties.

What does the NHS indemnity scheme cover?

It covers clinical negligence claims and legal defense costs for NHS-employed doctors. It provides protection when working in NHS settings, including teaching, research, and clinical practice. However, it may not cover private work or non-clinical duties.

Do I need additional coverage if I work privately?

Yes, if you undertake private practice or any work outside your NHS role, you may need additional coverage from a Medical Defence Organization (MDO). NHS one typically does not cover private work or consultancy.

How much does indemnity insurance cost for NHS doctors?

The cost depends on factors such as your grade, specialty, and whether you are working in the NHS or privately. Junior doctors (F1/F2) generally pay less, while consultants or doctors in high-risk specialties may have higher premiums. The cost can range from £100 to £1,500 per year.

What happens if I don’t have one?

Without the cover, you would not be able to legally practice medicine in the UK. Not having one means you would not have legal protection if a claim is made against you, potentially leaving you financially liable for legal fees and compensation.

What is the difference between NHS indemnity and MDO?

The NHS scheme is provided by the government and covers NHS-employed doctors for their clinical work. MDO is offered by private organizations and covers additional areas, including private work, non-clinical roles, and enhanced legal support.

Can this help with complaints or regulatory investigations?

Yes, indemnity insurance generally includes legal support for complaints, investigations by regulatory bodies such as the General Medical Council (GMC), and defense against professional misconduct claims. It helps doctors navigate legal and professional challenges that may arise during their careers.

Have recommendations or feedback on the indemnity insurance list?

We’re here to explore. Let’s talk.