Why You Must Get Financially Organised

Inflation is rising, and the cost of living is going up; financial literacy is no longer optional—it’s essential.

According to YCharts, the UK inflation rate is currently at 3.6%, which is above the Bank of England’s target of 2%. In simple terms, things are 3.6% more expensive than they were a year ago.

To illustrate:

If you have £10,000 in a regular savings account, in five years that money will only buy what approximately £8,400 can purchase today. Your balance hasn’t changed, but your spending power has decreased.

For healthcare professionals, that means reduced ability to cover:

- Exam fees

- Rent and bills

- Daily living expenses

- Travel and family support

You are losing money if your savings aren’t increasing at a pace that at least keeps up with inflation.

Disclaimer: This blog is not financial advice. It’s personal opinions and experiences. Please seek independent advice before making financial decisions.

Before You Start: Essentials

Before you start saving or investing, make sure:

- You have a spreadsheet of your monthly income, expenses and savings.

- You’ve cleared any high-interest debt (especially credit cards).

- You’ve defined your financial goals:

- Ultra short-term: 0–1 year (e.g. holiday, emergency fund)

- Short-term: 1–5 years (e.g. exams, moving house)

- Intermediate: 5–10 years (e.g. property deposit)

- Long-term: 10+ years (e.g. retirement, financial freedom)

1. Build Your Emergency Fund First

Save at least 6 months of living expenses in an easy-access, high-interest savings account.

This is your financial cushion for:

- Car repairs

- Unexpected bills

- Job changes or relocations

Check MoneySavingExpert for the latest providers with competitive interest rates.

2. Understand and Use ISAs

An ISA (Individual Savings Account) allows UK residents to save or invest money tax-free. No tax on:

- Interest

- Dividends

- Capital gains

Your ISA allowance for 2025/26 is £20,000, which can be split across multiple ISA types. But you can only pay into one of each type per tax year.

| ISA Type | Risk/Return | Purpose |

|---|---|---|

| Cash ISA | Low | Emergency savings, short-term goals |

| Stocks & Shares ISA | Medium–High | Long-term wealth building |

| Lifetime ISA (LISA) | Medium | First-time home purchase or retirement |

| Junior ISA | Low–Medium | Saving for children under 18 |

Cash ISA* Tax-free savings account.

- Easy access, low risk.

- Suitable for short-term savings but often fails to beat inflation.

- Best rates vary by provider—always compare before you choose.

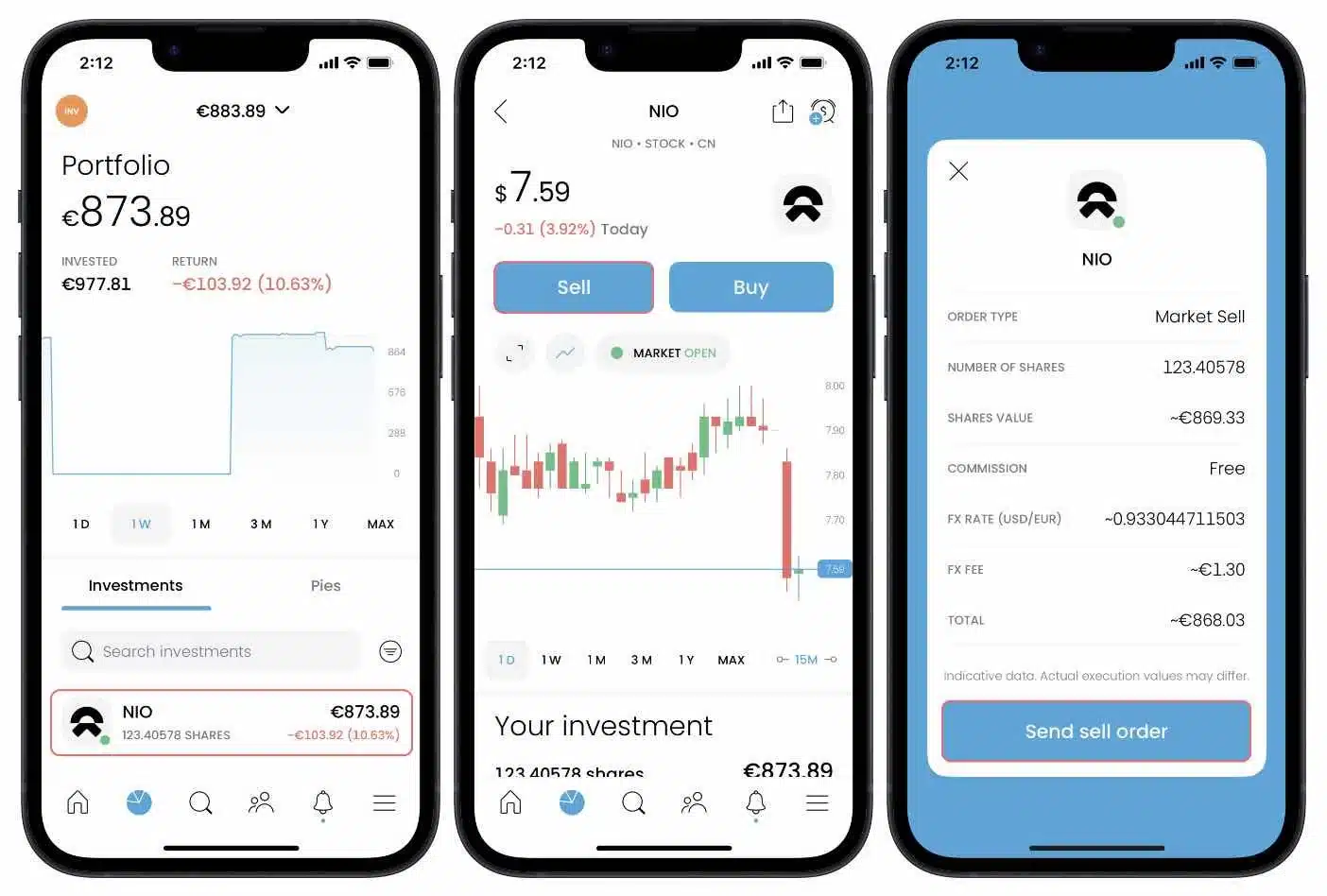

Stocks and Shares ISA

- Invest in the stock market.

- Higher potential returns (often 7–10% annually over the long term).

- Best for 5–10 year goals like property purchase or early retirement.

Passive Strategy Example:

A Global ETF (Exchange-Traded Fund) includes shares from companies worldwide, like Apple, Nestlé, and Toyota. This gives you:

- Instant global diversification

- Passive “buy and hold” growth

- Lower management fees than mutual funds

Don’t withdraw from this account early; short-term volatility can lead to losses.

Lifetime ISA (LISA)

- For ages 18–39

- Save up to £4,000/year

- Government adds a 25% bonus (£1,000/year)

- Use only for a first home or retirement (age 60+)

- Withdrawals for other reasons incur heavy penalties

Junior ISA

- Save for a child

- Grows tax-free until they turn 18

- They get complete control of the money at that point

How to Get Started with an ISA

- Choose a provider (e.g. Vanguard, AJ Bell, Hargreaves Lansdown)

- Select an ISA type based on your goals

- Set up a monthly contribution or lump sum

- Review periodically and adjust if needed

Quick Examples

- Cash ISA: £5,000 @ 4% = £200/year interest, tax-free

- Stocks & Shares ISA: £10,000 grows to £13,000 in 3 years = no tax on £3,000 gain

- LISA: Save £4,000 = £1,000 bonus from the government

You can also use your partner’s ISA allowance, doubling your household’s tax-free savings to £40,000. Just remember, gifted money becomes theirs.

Avoid ISAs from high street banks unless rates are competitive — many offer returns well below inflation.

3. NHS Pension – A Hidden Gem

The NHS Pension Scheme is one of the best pension plans in the UK.

- Employer contributions

- Inflation-linked returns

- No active management required* Transferable abroad (25% exit fee)

Do not choose to opt out if you do not fully understand the long-term effects.

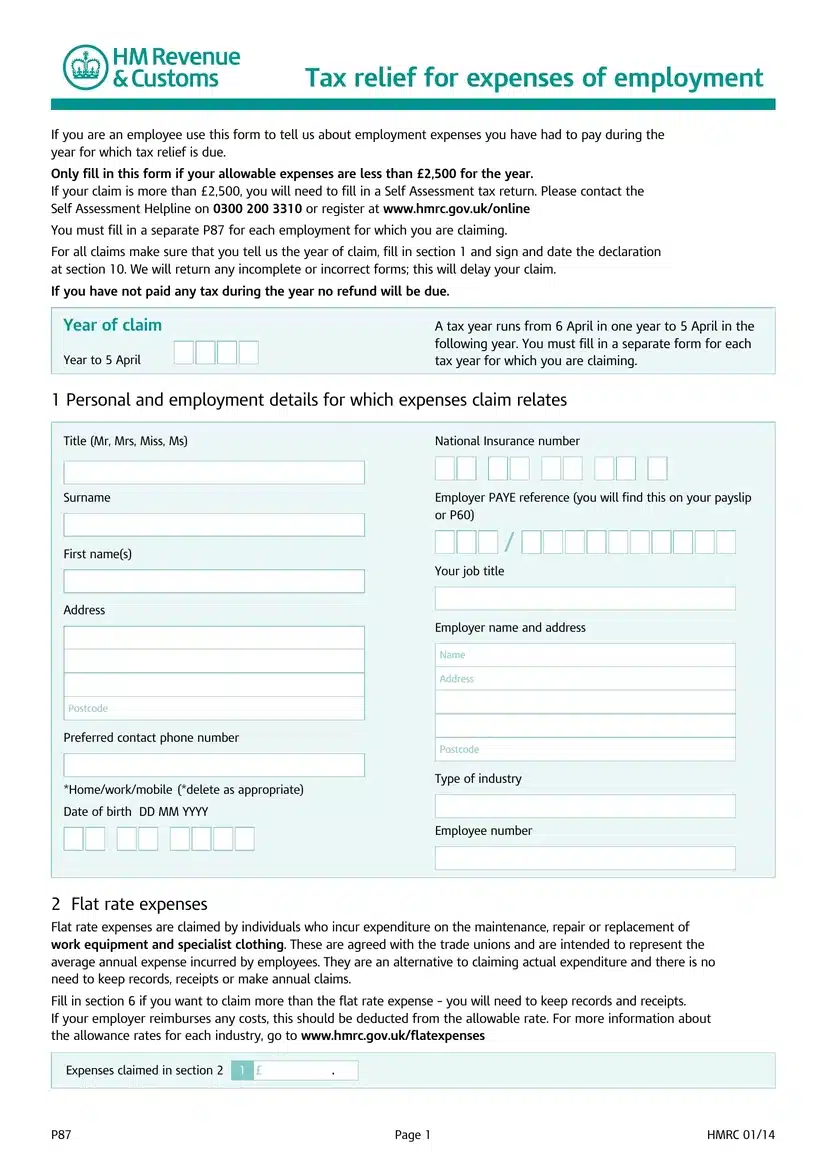

4. Wherever Possible, Claim Tax Relief

Eligible expenses for HMRC tax deductions:

- GMC fees

- Royal College memberships

- Exam fees

- Uniforms and medical equipment

- Professional development courses

Use the HMRC P87 form and make sure to keep all receipts and records.

5. Check Your NHS Payslip Every Month

Although frequently disregarded, this step is crucial.

- Check banding

- Spot underpayments or errors

- Pension contributions and tax codes

- Save a PDF copy to cloud storage

This helps with financial tracking, visa applications, revalidation and tax returns.

It is important

Conclusion

If you’re not investing time in your finances, you’re accepting unnecessary losses – in money, security and future freedom. Medical professionals have high earning potential but little financial education. By learning early, you can avoid burnout, financial regret and dependency on unstable income sources.

More to Read

- Best Cash ISA rates: MoneySavingExpert

- Financial literacy YouTube channels: